work in process inventory balance formula

This excludes the value of raw materials not yet incorporated into an item for sale. The conceptual explanation for this is that raw materials work-in-progress and finished goods current assets are turned into revenue.

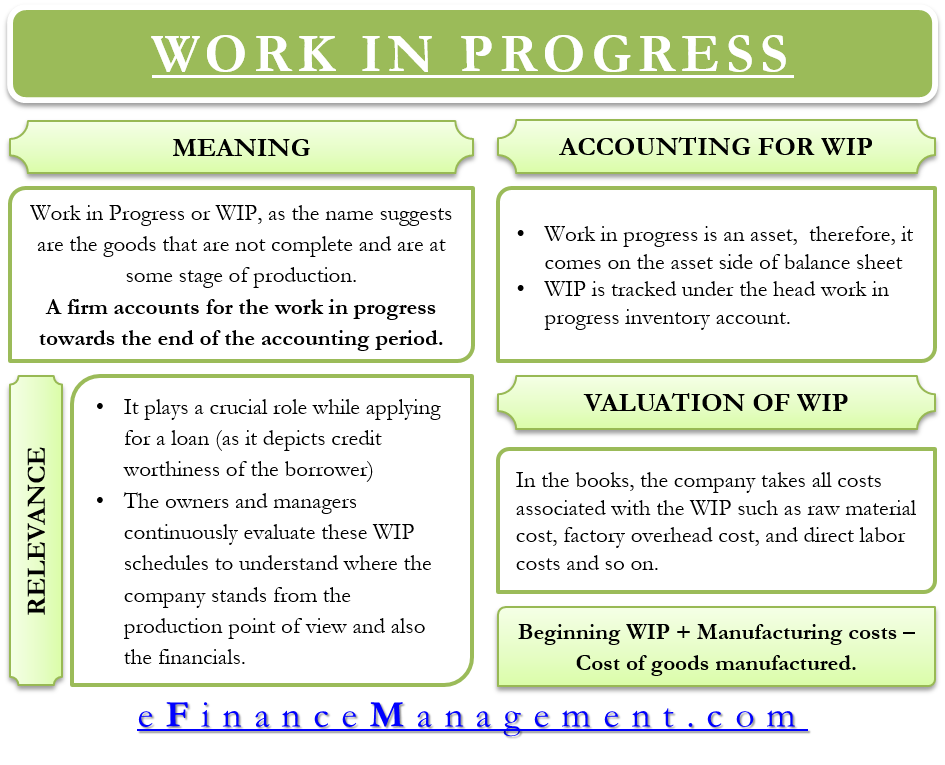

The amount of ending work in process must be derived as part of the period-end closing process and is also useful for tracking the volume of.

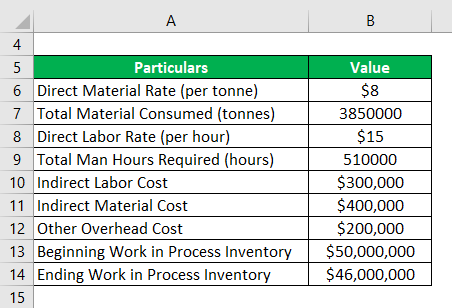

. Therefore the direct labour and the operational cost of putting the kettle together would be classified under work in. Work in process inventory formula. The formula is as follows.

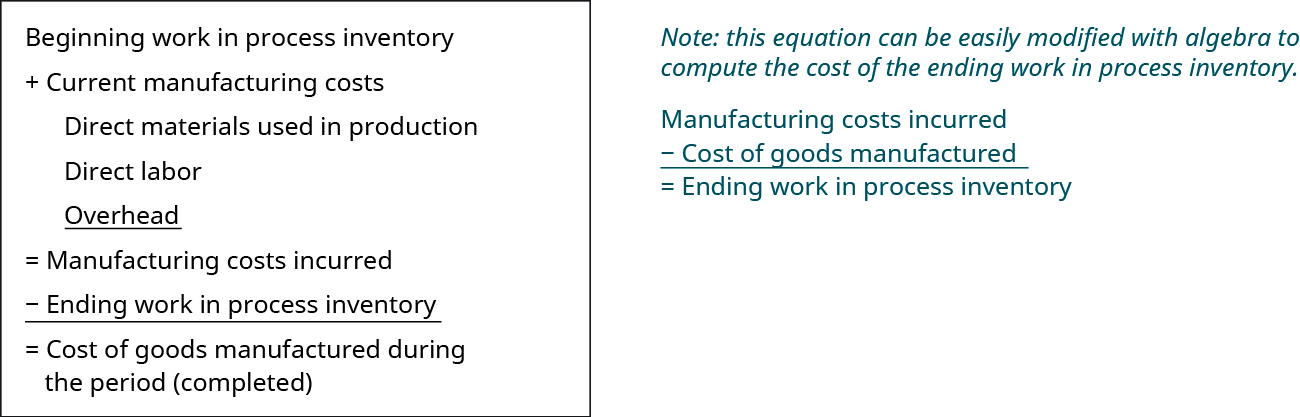

Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of Finished Goods. 5000 Beginning WIP 29000 Manufacturing costs - 30000 cost of goods manufactured. Work-in-progress is the goods which is currently in the process of production ie in the intermediate stage of production in between raw materials and finished goods.

WIP consists of the cost of raw materials labor and production overheads with respect to the level of completion. Work in process inventory calculations should refer to the past quarter month or year. This means that Crown Industries has 10000 work in process inventory with them.

However by using this formula you can get only an estimate of the work in process inventory. The WIP figure indicates your company has 60000 worth of inventory thats neither raw material nor finished goodsthats your work in process inventory. Imagine BlueCart Coffee Co.

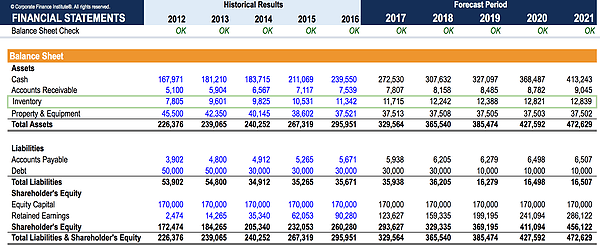

Similarly one may ask how do you calculate total work in process. The value of the partially completed inventory is sometimes also called goods in process on the balance sheet. Solved Calculate The Ending Work In Process Inventory Chegg Com How To Calculate Finished Goods Inventory Cost Of Goods Manufactured Formula Examples With Excel Template.

Once the manufacturer starts the production process those items are no longer raw materials. WIP Inventory amount Beginning Work in Process Inventory Manufacturing Costs Cost of Manufactured Goods Work in Process VS Work in Progress. The beginning WIP inventory cost refers to the previous accounting periods asset section of the balance sheet.

Work in process inventory formula. Lets use a best coffee roaster as an example. Main formulas for inventory management in the warehouse 1.

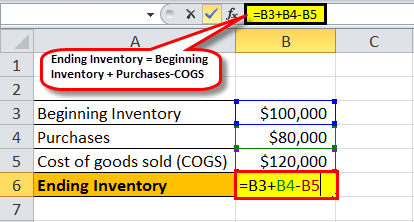

Ending Inventory Beginning Balance Purchases Cost of Goods Sold Higher sales and thus higher cost of goods sold leads to draining the inventory account. Work in process inventory balance formula Thursday March 10 2022 Edit. Inventories 302 M 8181 1120 M.

ABC International has beginning WIP of 5000 incurs manufacturing costs of 29000 during the month and records 30000 for the cost of goods manufactured during the month. It is generally considered a manufacturing best practice to minimize the amount of work-in-process in the production area. Therefore as per the formula 8000 240000 238000 10000 This means that Crown Industries has 10000 work in process inventory with them.

WIP does not include raw materials which is yet to be used. Subtract the value of finished goods from the previous period. Ending Inventory Beginning Inventory Inventory Purchases Cost of Goods Sold.

Work-in-process is an asset and so is aggregated into the inventory line item on the balance sheet usually being the smallest of the three main inventory accounts of which the others are raw materials and finished goods. The work in process formula is expressed as. Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory COGM.

The work in process formula is the beginning work in process amount plus manufacturing costs minus the cost of manufactured goods. WIPs are considered to be a current asset on the balance sheet. In this case for example consider any manufactured goods as work in process.

4000 Ending WIP. Its ending work in process is. Once youre able to determine your beginning WIP inventory and you calculate your manufacturing costs as well as your cost of manufactured goods you can easily determine how much WIP inventory you have.

The formula for this is as follows. The WIP figure reflects only the value of those products in some intermediate production stage. Formula s to Calculate Work in Process WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS Common Mistakes Ignoring work in process calculations entirely.

Every dollar invested in unsold inventory represents risk. Keep in mind this value is only an estimate. The ending WIP beginning WIP manufacturing costs - cost of goods produced This represents the value of the partially completed inventory which accounts for only a part of what the company will actually produce.

Click to see full answer. For the exact number of work in process inventory you need to calculate it manually. How to Calculate Ending Work In Process Inventory.

10000 300000 250000 60000. Work-In-Process Inventory Formula After the beginning WIP inventory is determined along with the manufacturing costs and the COGM its easy to calculate the amount of WIP inventory that you currently have. Work in process inventory 60000.

Add the new purchases and subtract the Cost of goods sold. The work in process inventory refers to the part of the production cycle of turning your individual raw materials into a kettle. So to calculate ending inventory for the period we will start will the inventory which is currently listed on companys balance sheet.

Work in process operating inventory goods in process raw materials used during the period direct labor during the period factory overhead for a period ending inventory. Beginning WIP Inventory Manufacturing Costs COGM Ending WIP Inventory. The formula for WIP is.

Add the value of goods added to work-in-process during the previous period to the beginning work-in-process inventory in the previous period. WIP is calculated as a sum of WIP inventory total direct labor costs and allocated overhead costs. A work-in-progress WIP is the cost of unfinished goods in the manufacturing process including labor raw materials and overhead.

The work in process formula is. The formula for calculating the WIP inventory is. Your WIP inventory formula would look like this.

Has a beginning work in process inventory for the quarter of 10000.

Work In Process Wip Inventory Youtube

Ending Inventory Formula Step By Step Calculation Examples

Inventory Formula Inventory Calculator Excel Template

Solved Calculate The Ending Work In Process Inventory Chegg Com

Cost Of Goods Manufactured Formula Examples With Excel Template

Inventory Raw Materials Work In Progress And Finished Goods

Work In Process Inventory Formula Wip Inventory Definition

Ending Work In Process Double Entry Bookkeeping

Work In Progress Meaning Importance Accounting And More

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

What Is Work In Progress Wip Finance Strategists

Ending Inventory Formula Step By Step Calculation Examples

What Is Work In Process Wip Inventory How To Calculate It Ware2go

Wip Inventory Definition Examples Of Work In Progress Inventory

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Manufactured Formula Examples With Excel Template

Use The Job Order Costing Method To Trace The Flow Of Product Costs Through The Inventory Accounts Principles Of Accounting Volume 2 Managerial Accounting

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com